The Solar Panel Installation Cost in 2023

This section determines direct and indirect installation costs of the system. Use hourly crew costs and all other installation costs to compute the accumulative TOTAL INSTALLATION COST. We recommend hiring a professional HVAC contractor to install your new air conditioner. These professionals are trained to install your AC system correctly and will ensure it functions efficiently. As of January 2023, SEER’s minimum allowable rating is 14 for northern regions and 15 for southern states.

- A local plumber can typically install gas or electric water heaters and charge between $45 and $150 an hour.

- Homeowners should budget for the best system they can afford and find a reliable gutter company to complete the project.

- However, it requires ladder safety knowledge and several tools, including a drill and tin snips.

- When a clog forms, it prevents water from draining properly, leading to overflow that can damage your home.

On average, flooring costs between $1,500 and $4,500 with an average price of about $3,000 to cover a 500-square-foot space. Electric or gas tank water heaters are the most budget-friendly water heaters to install. Most of the time, these water heaters cost between $550 and $1,500. Keep in mind that costs will rise if you need to install a new gas line or 240-volt electrical circuit, so go with what best suits your existing space.

Fuel Type

If the floor has excessive stains, foul odors, tears, or burns, then it’s a good idea to replace the carpet. Also, if you suspect that the carpet may be causing respiratory illness, it may be prudent to replace it. If you have parquet floors from the 1960s or vinyl from the 1970s, it may be time to replace those floors, too. A floor finish is recommended for natural stone, wood, or concrete and will keep floors in good condition, even in high-traffic areas. Costs to seal these floor types range between $0.85 to $7 per square foot. When selecting repair products for their utility, price is first and foremost in the minds of procurement managers.

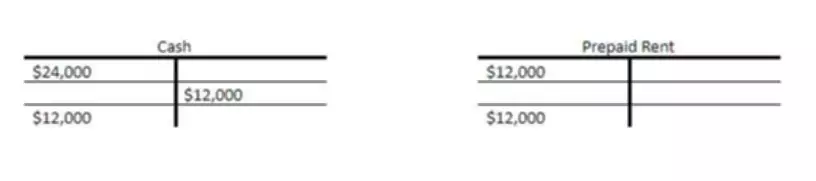

A tankless water heater typically runs around an hour a day, while a tank water heater may run four hours or more. If you notice that your water heater is running more than usual, call a certified plumber to inspect your heater for any problems. An electric tank is less expensive to understanding a balance sheet buy and install than a gas tank, with a residential 50-gallon tank water heater priced around $500. However, monthly operation tends to be more expensive than that of a gas heater. This heat source is considered safer than gas, as there’s a smaller risk of a leak or combustion.

Solar Panel Maintenance : Everything You Need to Know

If you know the signals, you can replace your unit before it causes a major problem. Removing your old water heater typically costs $100 to $500, depending on your contractor’s hourly rate. If the water heater is in an inaccessible area or it’s difficult to remove, costs will tilt toward the high end. You’ll also find high-efficiency, indirect, solar, and hybrid heat pump water heaters, which we describe in-depth in the next section. Gutter longevity is directly influenced by the durability of the materials used. For instance, vinyl or aluminum rain gutters should last at least 20 years when properly installed and maintained.

What To Consider Before Installing Your Own Hot Water Heater – House Digest

What To Consider Before Installing Your Own Hot Water Heater.

Posted: Thu, 29 Jun 2023 01:15:00 GMT [source]

The downside is that their attachment points weaken over time, leading to corrosion or leaks. Vinyl gutters are the most popular and budget-friendly option, costing $4 to $7 per linear foot. They’re made of plastic or polyvinyl chloride (PVC) and are not as durable as other gutters, so they don’t work well in climates with excessive snow, rain or high temperatures. These gutters last between 10 to 20 years, depending on your environment.

Vinyl and Linoleum

Other problems could be excessive squeaking or cupping of wood floors due to recent water damage. One reason may be because you are tired of the outdated flooring that you currently have installed. Another reason is that you might be trying to sell your home and a stager suggests that you change the floor to avoid distracting potential buyers.

For this job, skip the potential hazard and hire a water heater installer near you. If you notice your tap water has a metallic taste, it’s possible the metal from your water heater is leaking into your plumbing system. While this could signal that your water heater has irreparably corroded and will most likely leak, sometimes it also means you missed regular maintenance. If it’s the latter, draining your water heater—which you should do every year or so—may remove the funky taste.

Installation

The company provides professional installation and custom fits the gutters to your home. You will also benefit from a transferable lifetime finish warranty that covers repair or replacement if certain types of damage and deterioration occur. The size of your home, gutter materials and style of gutters all add to your total project cost. Labor costs increase with multi-story homes, roof accessibility and climate-specific add-ons and upgrades. Pricing also varies based on your geographic location and cost of living. The runtime of a water heater depends on the size, model, and fuel source.

What is considered an installation?

The term installation art is used to describe large-scale, mixed-media constructions, often designed for a specific place or for a temporary period of time.

The zinc coating will eventually deteriorate, but a galvanized steel gutter system can withstand the elements for 20 years or more. Your gutter contractor will base your gutter installation cost estimate on the following factors. LeafFilter offers a three-piece stainless steel micro-mesh gutter guard system. The 275-micron filter catches even the smallest debris, including pollen and shingle grit.

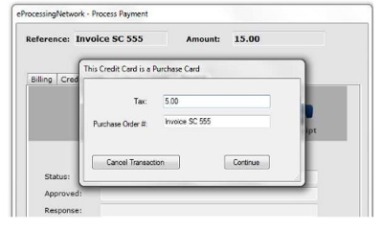

Is installation part of fixed asset cost?

Fixed assets should be recorded at cost of acquisition. Cost includes all expenditures directly related to the acquisition or construction of and the preparations for its intended use. Such costs as freight, sales tax, transportation, and installation should be capitalized.