Bookkeeping Services in the UK

Content

Thus, locate the space labeled “Accountant” and produce the legal name of the Accountant being commissioned. You must solidify this entity’s identity by producing his or her mailing address across the next three empty lines. The Client who intends to hire the Accountant named above through this paperwork must have his or her full name supplied on the blank line labeled “Client.” His or her mailing address should also be supplied here.

- This method is the best way to keep track of asset and liability accounts.

- You’ll want to consider the bookkeepers’ expertise level, types of services they offer, technology integration offerings, and what industries or niches they serve.

- Their role saves you time and it needs to be done correctly by an experienced and knowledgeable bookkeeper.

- With a list of bookkeeping services to regulate expenses and analyze results, you can steer your business to the next level.

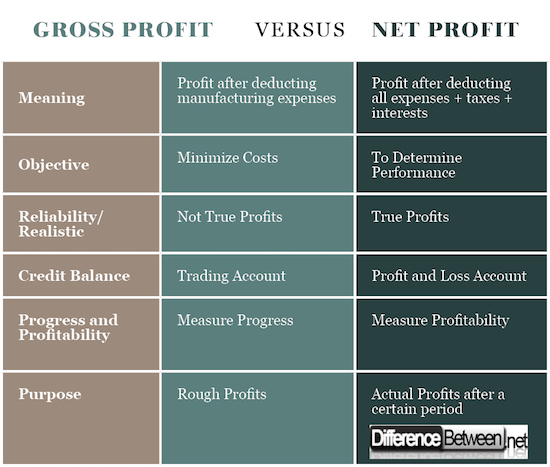

They also work to prepare for and minimize your small business taxes. This involves putting together monthly and quarterly statements and making quarterly tax filings. At least, those are the traditional roles of an accountant and a https://marketresearchtelecast.com/financial-planning-for-startups-how-accounting-services-can-help-new-ventures/292538/ bookkeeper. So your first consideration is whether you just need compliance – basic bookkeeping – or if you’re ready to graduate to full-service accounting that will help you drive increased profits, improved cash flow and growth.

What Does a Bookkeeper do?

Try us for free—we’ll do one prior month of your bookkeeping and prepare a set of financial statements for you to keep. A bookkeeper manages and records all of your business’s financial transactions. Typically, bookkeepers cannot file tax returns on behalf of other companies on their own.

We do Payroll for all countries in all software and comply with all tax formalities of the IRS, HMRC, ATO, etc. Tell us about your business and we’ll provide you with a simple solution. If you aren’t doing the bookkeeping yourself, follow up with who is. No matter what type of bookkeeping system you use, consistency is vital.

Invest in the Future of Your Business

Bookkeeping is an unavoidable part of having a business because the IRS has certain rules around financial recordkeeping. Aside from staying compliant, having organized books helps you monitor the health of your business, prepare for tax time, and prepare key financial statements. Part-time bookkeepers typically perform smaller tasks like inputting receipts and keeping tabs on employee timesheets. Companies will often choose to train an existing employee or office manager to take on the extra responsibilities of a part-time bookkeeper. While this may be a lucrative option on paper, any oversight or error in the sheets will come at your company’s expense. Handling payroll taxes, employee benefits, paying for sick leave and recruitment costs, or worrying about administrative overheads becomes a thing of the past as our virtual assistants work even on holidays.

To keep the taxman happy and stop you from paying any additional fines, a bookkeeper will make sure your records are accurate, so you’re always prepared for tax. A bookkeeper can stay on top of your business’ accounts daily for all transactions. By keeping track of every sale or purchase and using software to do it all, it’s much easier for them to keep an eye on your cash flow. Our goal as an outsourced financial services provider is to empower our clients with the ability to transform their back office functions into a catalyst for growth.

Best Online Bookkeeping Services for Small Businesses

And this is where we bring in the third prong of the bookkeeping service, the controller. The controller increases the company’s overall financial accountability and checks and balances. A controller reviews the bookkeeper’s ledger for accuracy while also maintaining the integrity of the accounting data file in the future so that adjustments can’t be made without approval.

- Using the rules of double-entry, these journal summaries are then transferred to their respective accounts in the ledger, or account book.

- It involves recording transactions and storing financial documentation to manage the overall financial health of an organization.

- This often involves setting up accounting software and linking it with the client’s bank to pull through transaction data.

- Finally, you’ll want to decide how all receipts and documents will be stored.

- Accountants typically have a higher degree of expertise than bookkeepers.

- While there are certain scenarios where it makes sense to have a dedicated bookkeeper (or several) on your staff, this is typically reserved for very large companies.

However, it’s important to remember that expert financial insights don’t have to cost a fortune—the information that you can get from an online bookkeeping service can prove quite valuable. Small business owners notoriously spend a large amount of time on administrative work, like employee scheduling, preparing payroll, and especially hours and hours of bookkeeping. It is estimated that SMBs spend 120 working days per year on these administrative tasks and bookkeeping. This is time that could be spent doing the work you love that led you to start a small business in the first place.

It involves recording transactions and storing financial documentation to manage the overall financial health of an organization. Most businesses use an electronic method for their bookkeeping, whether it’s a simple spreadsheet or more advanced, specialized software. With remote bookkeeping services, you can trust another professional to tackle all of your tasks.