Finance vs Accounting: What’s the Difference?

Contents:

Liabilities deal with what the company owes, such as accounts payable, loans payable, mortgages and payroll. Prepare the adjusted trial balance to ensure these financial balances are materially correct and reasonable. Take our free career test to find out if accountant is one of your top career matches. John Iwuozor is a freelance writer with expertise in the technology field.

- The role of a Certified Public Accountant, or CPA, is to act as a financial consultant or advisor to individuals and businesses on issues like tax compliance and business planning.

- The frequency in which you review and evaluate your methods is bound to be unique to your specific business.

- Accounting can be classified into two categories – financial accounting and managerial accounting.

- This principle dictates how much revenue should be recorded, the timing of when that revenue is reported, and circumstances in which revenue should not be reflected within a set of financial statements.

- It’s also true that every accountant who files a report with the Securities and Exchange Commission is lawfully required to be a Certified Public Accountant .

quickbooks payroll accountants overseeing returns in the United States rely on guidance from the Internal Revenue Service. Federal tax returns must comply with tax guidance outlined by the Internal Revenue Code . The Alliance for Responsible Professional Licensing was formed in August 2019 in response to a series of state deregulatory proposals making the requirements to become a CPA more lenient. The ARPL is a coalition of various advanced professional groups including engineers, accountants, and architects. Accounting helps a business understand its financial position to be able to make informed decisions and manage risks. Modern accountants should develop an analytical mindset in order to keep up with trends in the industry and remain competitive in the workforce.

Balance Sheet

They also determine what these statements reveal based on knowledge of the foreign country’s economic and cultural atmosphere. They must hold a bachelor’s degree in accounting, finance, or business administration and complete an additional 150 hours of professional education. They also must pass the Uniform CPA Exam and have two or more years of experience in public accounting. Outsourced accounting firms provide a full accounting department for businesses for a lot less than the cost of a full internal staff. Some will provide the same services as a full-service firm, while others may provide only a subset of these services. If your business ever grows to the point where you need to hire an accountant full-time, most of their time will be taken up by managerial accounting.

Helping an accountant understand the business dynamics, staff skills, and capabilities, in turn, makes the analysis and problem-solving much easier tasks. An accounting job, contrary to popular belief, is not just gathering financial information and crunching numbers for their clients. And getting an accounting degree does not require someone to be a math genius. It does, however, require a hefty amount of creative problem solving and providing goal-oriented plans. Accounting can be classified into two categories – financial accounting and managerial accounting.

Principles of Financial Accounting

Their time-tracking functionality also makes it easy for freelancers who bill by the hour. Freshbooks is a good fit for someone generating a lot of invoices with a low number of transactions. By referring to your balance sheet, you can track how effectively you’re collecting payment. Then you can put in place processes—like harder payment deadlines or better follow-up with clients—to make sure you get your hands on the money you’ve earned when you need it.

In other words, accountants are the financial superheroes you need. Hiring an accountant for your small business is one of the best ways to make sure your books are right from the start. Real accounts are permanent accounts, they are recorded in the balance sheet and are not closed at the end of an accounting year. A CPA, or “Certified Public Accountant”, is recognized in the accounting field.

To support senior management in the decision-making process by appropriately presenting the financial data. Successful accountants can communicate comfortably with both clients and stakeholders and explain information in terms they will understand. (Hallelujah for modern-day technology, right? 🙌🏼) Check out solutions like Gusto, Zenefits, and Intuit Quickbooks Payroll.

Is your small business considering an accounting firm?

Financial accounting creates a standard set of rules for preparing financial statements. This standard set of rules creates consistency across reporting periods and across different companies. An income statement is useful to management, though cost accounting techniques may allow a company to determine better production and pricing strategies compared to financial accounting. Instead, financial accounting rules regarding an income statement are more useful for investors seeking to see how profitable a company is and external parties looking to assess the risk or consistency of operations. International accountants work with companies or organizations that conduct business internationally. They may work to recast foreign financial statements to align with the U.S. generally accepted accounting principles .

Although commonly hired by construction companies and engineering firms, project accountants can find work in any sector. A financial statement of a company can be created at any given point for a selected period of time. Every company has a different accounting cycle, some even do it monthly. Leadership skills are widely appreciated in the work industry, regardless of the job description. These skills include traits that are not usually natural to a lot of people. When it comes to accountants, this asset becomes important exactly because of the characteristics it carries.

This will save you stress and give you the needed time to focus on other important parts of your business. In accounting, you’ll come across certain titles which appear to bear similar duties but actually have unique job descriptions. In this section, we’ll briefly review the roles of accountants vs. CPAs and tax professionals. To learn more about this, and other bachelor’s degree programs that can propel your accounting career, explore our program pages.

Accountants demand change or else – CFO Dive

Accountants demand change or else.

Posted: Fri, 14 Apr 2023 20:21:24 GMT [source]

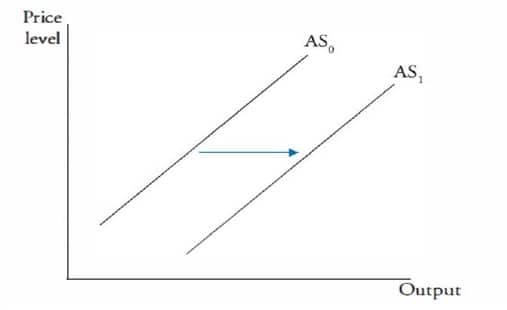

Imagine a company received an invoice for $5,000 for July utility usage. Even though the company won’t pay the bill until August, the accrual method of accounting calls for the company to record the transaction in July. In addition to debiting Utility Expense, the company records a credit to accounts payable. Finance and accounting operate on different levels of the asset management spectrum. Accounting provides a snapshot of an organization’s financial situation using past and present transactional data, while finance is inherently forward-looking; all value comes from the future.

Generally, auditors work as part of a team or department, but some auditors work from home, while others travel to their clients’ places of business. In addition, they prepare data for use within a company by forecasting cash flows, creating budgets, and analyzing the rate of return for short and long-term projects. Employed by federal, state and local governments, tax examiners review the relatively simple tax returns filed by individuals and small businesses. They determine how much tax is owed, check returns for completeness and accuracy, code returns for processing, conduct audits and collect overdue tax payments. Tax examiners may also discuss erroneous or missing information on returns with taxpayers.

Northeastern and MLB have joined forces to help professional baseball players have access to higher education degrees. The Lowell Institute School is the premier institution for you to finish your bachelor’s in science, technology, or engineering. After enrolling in a program, you may request a withdrawal with refund (minus a $100 nonrefundable enrollment fee) up until 24 hours after the start of your program.

Staying informed, continually improving, and critical thinking are the key components of https://1investing.in/ing accounting. Having analytical skills translates into having the ability to collect information and analyze it, make decisions, and have a knack for problem-solving. All of this would, for the most part, involve a lot of critical thinking and strategizing solutions, which are the end product of an accounting job. Creditors are the primary external users of accounting information.

At the end of a reporting period, list all of your business’s accounts and figure out their balances. As well as the preparation of reports on project management, budget, and more. However, their major focus is on managing immediate financial issues. And the preparation of reports on project management, budget, and more.