A Beginner’s Guide to Bookkeeping

Your goal in bookkeeping is to keep the most accurately detailed account of business financials. In the cash method of accounting, you record the transaction only when the money has actually changed hands. So, even though you received an invoice in January, you’d record the expense as a cash transaction in February, on the date that it was paid. Frequent financial reports are a great way to check on your budget, and figure out where you can make adjustments if necessary. Reporting crucial financial dataabout your firm to potential investors and other stakeholders. Bookkeeping programs that incorporate graphs, charts, and other visual aids make it easier to increase data precision and improve communication when you’re wooing investors.

You can also find manuals focusing on the proper use of QuickBooks and Xero, the most common bookkeeping programs used by small business bookkeepers. Bookkeepers working for small businesses and self-employed workers can learn how to claim overlooked tax deductions with 475 Tax Deductions for Businesses and Self-Employed Individuals. Author Bernard B. Kamaroff explains the benefits of deducting every allowable penny can and helps identify a wide range of deductions you may not have realized the IRS permitted.

FAQ: Bookkeeping books

Bookkeeping is the recording of financial events that take place in a company. Any process of recording financial data is considered bookkeeping and is the first step of data entry into the accounting system. Standard methods of bookkeeping are the double-entry bookkeeping system and the single-entry bookkeeping system. Good bookkeeping practices are essential for a business to succeed, especially when it comes to the tax-paying season.

Trump’s New Accounting Firm Agrees to Respond to New York AG Subpoena – Yahoo News

Trump’s New Accounting Firm Agrees to Respond to New York AG Subpoena.

Posted: Mon, 10 Apr 2023 14:57:29 GMT [source]

Effective bookkeeping requires an understanding of the firm’s basic accounts. These accounts and their sub-accounts make up the company’s chart of accounts. Assets, liabilities, and equity make up the accounts that compose the company’s balance sheet. Bookkeeping in a business firm is an important, but preliminary, function to the actual accounting function. Bookkeeping is the ongoing recording and organization of the daily financial transactions of a business and is part of a business’s overall accounting processes. The single-entry bookkeeping method is often preferred for sole proprietors, small startups, and companies with unfussy or minimal transaction activity.

Sending invoices to clients for services or purchases so the company knows what is due to them. If you’re using the wrong credit or debit card, it could be costing you serious money. Our experts love this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee.

What is Bookkeeping – EXPLAINED

If you’re looking to convert from manual bookkeeping to digital, consider a staggered approach. Overhauling all at once can be overwhelming and discouraging, so it’s best to take it slow and make meaningful and intentional shifts. Not only does the activity require extreme organizational, management, and math skills, but a bookkeeper must also have people skills in order to make this work.

The only pitfall of this book is that a few answers are given wrong. The author/editor needs to look at them to make this book completely error-free and easily digestible. You will not learn all of it in a day, but if you keep reading and implementing what you learn from this book, you will be good enough in a few short days. Explain the ethical and social responsibilities of bookkeepers in ensuring the integrity of financial information.

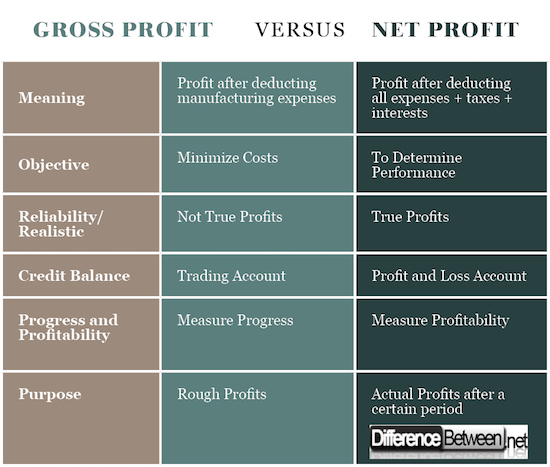

Because bookkeeping involves the creation of financial reports, you will have access to information that provides accurate indicators of measurable success. By having access to this data, businesses of all sizes and ages can make strategic plans and develop realistic objectives. Accounting, on the other hand, refers to preparing, reporting, analyzing, and summarizing financial data collected by bookkeepers. The accounting reports give a snapshot of the financial position as well as the performance of your business. Accounting MethodAccounting methods define the set of rules and procedure that an organization must adhere to while recording the business revenue and expenditure. Cash accounting and accrual accounting are the two significant accounting methods.

History of bookkeeping

This process can be as simple as preparing an invoice for a customer to setting up your electric bill to be paid. One of the great things about using a software is that the debits and credits involved in creating an invoice are all handled behind the scenes. A business’s six basic accounts are Assets, Liabilities, Equity, Revenue, Expenses, and Costs. The chart of accounts lists every account the business needs and should have.

Daily records were then transferred to a daybook or account ledger to balance the accounts and to create a permanent journal; then the waste book could be discarded, hence the name. Revenue is all the income a business receives in selling its products or services. Costs, also known as the cost of goods sold, is all the money a business spends to buy or manufacture the goods or services it sells to its customers. The Purchases account on the chart of accounts tracks goods purchased. If your company is larger and more complex, you need to set up a double-entry bookkeeping system.

Starting a Bookkeeping Business in 3 Easy…

Bookkeeping is where accountants generally start their careers as the barriers to entry are lower and pay is decent. You may be able to get on-the-job training through a bookkeeping job that only requires a high school diploma, such as an internship or training placement. You may also pursue certification programs or use online courses to become a self-taught bookkeeper.

Bookkeepers make sure the information in the books is accurate and that the books are reconciled each month. In essence, they complete the first step in the accounting process. Optical character recognition and bank feeds have come just short of fully automating the traditional bookkeeping process.

First, you can read it as a textbook, highlighting the important areas and implementing the most relevant ideas. You can read a chapter, implement the ideas, and then read another chapter and do the same. No matter whatever method you choose to read the book, this book is an invaluable resource for building a bookkeeping business. When she is presented with short lessons, easy-to-understand language, and a way to implement immediately what she has been learning. Written in short chapters, this book will teach you the double-entry bookkeeping system like no other in the market. Without understanding fundamentals, no software will be able to help you.

Many https://1investing.in/ers who have gone through this book have mentioned that this book is the thing they were searching for. Revenue refers to all the income that comes into the business after selling products and services. Inventory – These are the products not yet sold, which business owners should always keep track of. Previously recorded inventory should be regularly reviewed against the current inventory on hand through manual counting. Your general ledger should be up to date, so your bookkeeping software must provide functionality that you can navigate easily. QuickBooks is an excellent option for novice and seasoned digital bookkeepers.

Seasoned bookkeeper can allow you to focus on your business plan and growth. Stockholders’ equity accounts such as common stock, treasury stock, and retained earnings. Each province in Canada has a different threshold for when a business owner is required to pay taxes by quarterly instalments, instead of as a lump sum at the end of the year. In the accrual method, on the other hand, you would record the expense in January, on the date that you received the invoice — regardless of when you ended up paying for the parts. With many options for selling shares in your business, it can be overwhelming deciding how you’d like to structure your shares. We at Osome have created this guide to help you understand all possible options.

- Most businesses use an electronic method for their bookkeeping, whether it’s a simple spreadsheet or more advanced, specialized software.

- Maintaining daily records allows you to easily keep track of your business’s financial condition.

- QuickBooks is an excellent option for novice and seasoned digital bookkeepers.

- Consider long-term goals and KPIs, reflect on how your business is structured, and decide what you pay attention to.

- One of the first challenges new business owners face is managing their business’s bookkeeping.

The wave accounting brings the books to the trial balance stage, from which an accountant may prepare financial reports for the organisation, such as the income statement and balance sheet. In Bookkeeping Essentials, author Steven M. Bragg offers a textbook-style reference guide for new and experienced bookkeepers. Early chapters provide concise definitions for concepts such as balance sheets, accounting cycles, and accrual accounting methods. By including helpful charts and concrete examples of various transactions, the author provides visual aids to help the reader to understand how to process their entries. When it’s finally time to audit all reported financial transactions, bookkeepers produce reports that give an accurate look into how the company delegated its capital. The two key reports that bookkeepers provide are the balance sheet and the income statement.