How is the Average Directional Index ADX calculated and what is the formula?

Contents:

In such markets, buy orders are placed off support areas, while sell orders are placed off resistance areas. ADX indicatorThe black line marked with an arrow shows the ADX line. This is the line that you will use to determine the trend strength, and its reading is not affected by the direction of the trend. As you see, the ADX line goes back and forth, as the trend strength of the market changes. The ADX is also sometimes used, as other momentum indicators are, as a divergence indicator that can signal an impending trend change or market reversal. You may need to adjust ADX indicator settings based on the asset that you choose to trade.

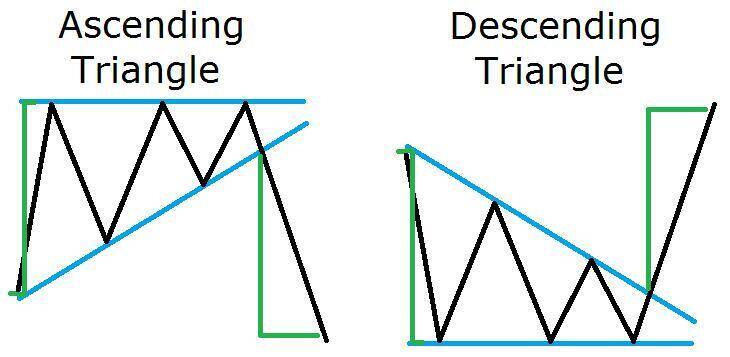

A wrong combination can also lead to laying more emphasis on a single price element while overlooking other crucial cues. In the above case, a trader could land up focusing on trend momentum while overlooking other important elements such as volatility. Breakouts frequently happen in the markets, and they can offer a big opportunity for traders.

And since a market is unlikely to stay at extreme readings for very long, the result when accounting for all the values during the period won’t be that high. Many traders want to know the best settings for their particular indicator. However, the harsh truth is that the best settings for any indicator will vary greatly depending on the market, timeframe, and strategy traded. In the image below, a high ADX reading is highlighted with a circle. Notice how the ADX reading went up together with the increase in market trend strength, coming from a low volatility environment.

Main ADX Indicator Trading Strategies FAQ

Short-term traders could enter trades when the two lines move apart to take advantage of increasing volatility. Swing traders might accumulate into a position when the lines contact in anticipation of a breakout. Those interested in learning more about ADX and other financial topics may want to consider enrolling in one of the best technical analysis courses currently available. The chart above shows AT&T with three signals over a 12-month period.

Price Zone Oscillator – Technical Analysis – Investopedia

Price Zone Oscillator – Technical Analysis.

Posted: Thu, 09 Nov 2017 00:52:45 GMT [source]

There is a different formula used for each of the three indicators. The DMI is built on a ratio of exponential moving averages, or EMAs, of the upward price movements , downward price movements and the true range of the prices . These are often expressed in an equation as EMAUP, EMADOWN and EMATR.

Reading the ADX Indicator

The https://traderoom.info/ True Range indicator, and Parabolic SAR are two well-known examples. No, this strategy has not been backtested yet, but I have used it along with some trend following systems and it works well. Finally, don’t worry about the complex nature of these calculations as we have everything covered in the excel sheet which can be downloaded from the end of this post. Use indicators after downloading one of the trading platforms, offered by IFC Markets.

Trading strategies usually require multiple technical analysis indicators to increase forecast accuracy. Lagging technical indicators show past trends, while leading indicators predict upcoming moves. When selecting trading indicators, also consider different types of charting tools, such as volume, momentum, volatility and trend indicators. ADX gives great strategy signals when combined with price. First, use ADX to determine whether prices are trending or non-trending, and then choose the appropriate trading strategy for the condition.

Our Experiences With ADX

The average directional index is indicative of the overall strength and direction of a trend. The purpose of the average directional movement index is to measure the strength of a trend and create buy or sell signals, depending if the trader should go long or short on an asset. Wilder put forth a simple system for trading with these directional movement indicators. The first requirement is for ADX to be trading above 25. Wilder based the initial stop on the low of the signal day. The signal remains in force as long as this low holds, even if +DI crosses back below -DI.

To demonstrate this, I’ve applied three ADX indicators to a chart. The ADX at the top uses has a length of 5, the middle a length of 10, and the one at the bottom a length of 20. In the image below, you see how a high ADX reading, coupled with oversold RSI readings, preceded a market reversal. There are many trading indicators that promise to help you find profitable trading opportunities. automatically, including our own trading platform, Next Generation. The indicator also has an alert function which can be used to send email or push notifications to the trader’s mobile device.

ADX is non-directional and quantifies trend strength by rising in both uptrends and downtrends. To calculate the ADX, first determine the + and – directional movement, or DM. The +DM and -DM are found by calculating the « up-move, » or current high minus the previous high, and « down-move, » or current low minus the previous low. If the up-move is greater than the down-move and greater than zero, the +DM equals the up-move; otherwise, it equals zero. If the down-move is greater than the up-move and greater than zero, the -DM equals the down-move; otherwise, it equals zero. The Average Directional Index is in turn derived from the smoothed averages of the difference between +DI and -DI; it measures the strength of the trend over time.

The positive directional indicator, or +DI, equals 100 times the exponential moving average of +DM divided by the average true range over a given number of time periods. The negative directional indicator, or -DI, equals 100 times the exponential moving average of -DM divided by the average true range . The ADX indicator itself equals 100 times the exponential moving average of the absolute value of (+DI minus -DI) divided by (+DI plus -DI). It is common investing wisdom that detecting and trading in the direction of a strong trend is a profitable strategy with minimal risk exposure.

Grid Builder Indicator for MT4

It equals the absolute value of +DI14 minus -DI14 divided by the sum of +DI14 and – DI14. If the +DI is already above the -DI, when the ADX moves above 25 that could trigger a long trade. Welles Wilder in 1978, shows the strength of a trend, either up or down. The Directional Movement Index is +DI minus -DI, divided by the sum of +DI and -DI . Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

How to Interpret the Volume Zone Oscillator – Investopedia

How to Interpret the Volume Zone Oscillator.

Posted: Wed, 25 Aug 2021 07:00:00 GMT [source]

The Average Directional Index is a specific indicator used by technical analysts and traders in order to determine the strength of a trend. It is for this reason that the average directional index is presented with three separate lines, symbolizing each indicator. Each line is used to help assess a trade and whether or not it should taken long or short, if at all.

Determining the trend direction is important for maximizing the potential success of a trade. The Relative Strength Index is a momentum indicator that measures the magnitude of recent price changes to analyze overbought or oversold conditions. The series of ADX peaks are also a visual representation of overall trend momentum.

What Is the Volume Price Trend (VPT) Trading Indicator? – Investopedia

What Is the Volume Price Trend (VPT) Trading Indicator?.

Posted: Sun, 26 Mar 2017 00:23:31 GMT [source]

When price makes a higher high and ADX makes a lower high, there is negative divergence, or non-confirmation. In general, divergence is not a signal for a reversal, but rather a warning that trend momentum is changing. It may be appropriate to tighten the stop-loss or take partial profits. After all these steps, it is time to calculate the Average Directional Index line. Subsequent ADX values are smoothed by multiplying the previous 14-day ADX value by 13, adding the most recent DX value and dividing this total by 14.

The red line is the negative directional indicator(DI-). ADX values will rise to increasingly high levels along with price in a market that is trending strongly higher. In such a situation, analysts will carefully monitor price movement for further indications of a possible trend change, the ADX decline having served as a sort of early warning signal. Also may I know where you posted for daily ADX, I want to use it. The two indicators both have crossover signals, but they are calculated in different ways and are measuring different things.

- These moments in question are known as “false signals” and are most common when ADX is calculated below 25.

- Although it has its own limitations, coupling it with other indicators will lead to a strong trading strategy.

- Both +DI and -DI measure up and down price movement, and crossovers of these lines can be used as trade signals.

- These two indicators are often collectively referred to as the Directional Movement Indicator .

If we were to use the adx indicator formula indicator as to the trading strategy, the returns would be plotted in the following manner. Let us take a few cases where we could use the ADX indicator as part of a trading strategy. Here we can see a number of times the Positive Directional Indicator crossed over from under the Negative Directional Indicator. But, as we mentioned above, we check the ADX indicator level as well to ascertain the strength of the trend. Since we are taking the time period as 5, we take the average of the five values. Thus, in this manner, we have understood the directional movements.

This article would focus on the most versatile Trend strength indicator used by Technical analysts know as Average Directional Index . This indicator aids in determining the strength of ongoing trend, and when combined with two supplementary indicators (+DI & -DI) it also helps in interpreting the direction of trend. We would learn how to trade with the help of these 3 indicators and always stay with the trend in correct direction.

Directional movement is positive when the current high minus the prior high is greater than the prior low minus the current low. Directional movement is calculated by comparing the difference between two consecutive lows with the difference between their respective highs. In order to get the ADX, you’ll need to continue calculating the DX values for x periods. Smooth the results of the periods in order to get your ADX value.

In that respect, we find the actual range of the price action between the days. Although it may be regarded as a feature, ADX doesn’t give clues about the direction of the trend, but requires us to resort to comparing the DI values to each other. ADX is a lagging indicator, which means that it reacts first when a trend has been initiated. In that regard, it may not be an effective tool when it comes to spotting early emerging trends. As you see, these quite a big difference between the three. For instance, it’s not uncommon to see that the 10-period ADX only outputs half the reading of the 5-period ADX.